“Most strategy dialogues end up with executives talking at cross-purposes because … nobody knows exactly what is meant by vision and strategy, and no two people ever quite agree on which topics belong where. That is why, when you ask members of an executive team to describe and explain the corporate strategy, you frequently get wildly different answers. We just don’t have a good business discipline for converging on issues this abstract.”

—Geoffrey Moore, Escape Velocity

Lean Portfolio Management

The Lean Portfolio Management competency aligns strategy and execution by applying Lean and systems thinking approaches to strategy and investment funding, Agile portfolio operations, and governance.It is one of the seven core competencies of the Lean Enterprise, each of which is essential to achieving Business Agility. Each core competency is supported by a specific assessment, which enables the enterprise to assess their proficiency. These core competency assessments, along with recommended improvement opportunities, are available from the Measure and Grow article.

Lean Portfolio Management describes how a SAFe portfolio is a collection of Value Streams for a specific business domain in an Enterprise. Each value stream delivers one or more Solutions that help the enterprise meet its business strategy. These value streams develop products or solutions for external customers or create solutions for internal operational value streams.

One SAFe portfolio can typically govern the entire solution set for a small-to-medium-size organization. Large enterprises often require multiple portfolios, usually for each line of business, business unit, or division.

Why Lean Portfolio Management?

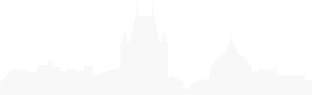

Traditional approaches to portfolio management were not designed for a global economy or the impact of digital disruption. These factors put pressure on enterprises to work under a higher degree of uncertainty and deliver innovative solutions much faster. Despite this new reality, many legacy portfolio practices remain, as illustrated in Figure 1.

Portfolio Management approaches must be modernized to support the Lean-Agile way of working. Fortunately, many enterprises have already traveled this path, and the change patterns are apparent, as shown in Figure 1. The LPM function has the highest level of decision-making and financial accountability for the solutions and value streams in a SAFe portfolio to address the challenge of defining, communicating, and aligning strategy.

The people who fulfill the LPM function have various titles and roles and are often distributed throughout the organization’s hierarchy. Because LPM is critical to the Lean Enterprise, these responsibilities are commonly held by business managers and executives who understand the enterprise’s financial, technical, and business contexts. They are accountable for the overall business outcomes.

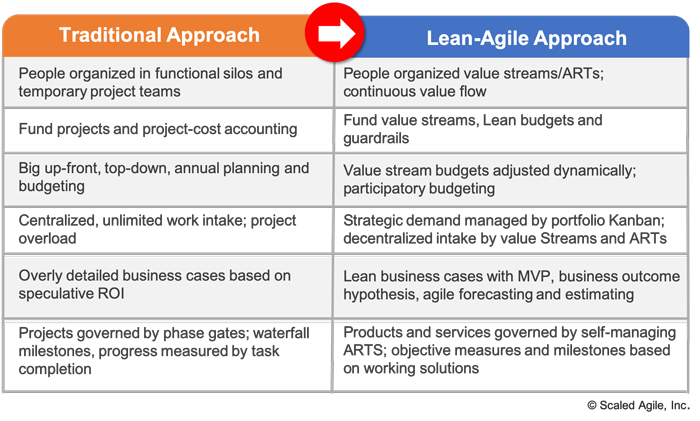

Figure 2 illustrates the three dimensions of the Lean Portfolio Management competency, followed by a brief description of each:

- Strategy & Investment Funding ensures the entire portfolio is aligned and funded to create and maintain the solutions needed to meet business targets.

- Agile Portfolio Operations coordinates and supports decentralized program execution and fosters operational excellence.

- Lean Governance is the oversight and decision-making of spending, audit and compliance, forecasting expenses, and measurement.

The following sections describe these dimensions in greater detail.

Strategy and Investment Funding

Strategy and investment funding ensures that the entire portfolio is aligned and funded to create and maintain the solutions needed to meet business targets. Only by allocating the ‘right investments’ to building the ‘right things’ can an enterprise accomplish its ultimate business objectives. However, portfolio strategy is much more than prioritization and selection of the best investments. The portfolio must understand its role in achieving the enterprise strategy. Therefore, LPM must understand the portfolio’s current state and develop a plan to evolve to a better, differentiated future state, and continuously adjust the vision and the plan to address the changing business context.

The strategy and investment funding collaboration (Figure 3) requires executives, Business Owners, portfolio stakeholders, technologists, and Enterprise Architects. Each responsibility is described next.

Connect the Portfolio to the Enterprise Strategy

The portfolio strategy must support the enterprise’s broader business objectives. That’s why connecting the portfolio to the enterprise strategy is the primary responsibility of the strategy and investment funding collaboration.

Moreover, linking the portfolio to the organization’s strategy is bi-directional. The portfolio is connected to the enterprise business strategy by Strategic Themes and the portfolio budget. It provides feedback to the enterprise via the portfolio context (described in the Enterprise article).

Maintain a Portfolio Vision

Portfolio Vision

The Portfolio Vision is a description of the future state of a portfolio’s Value Streams and Solutions and describes how they will cooperate to achieve the portfolio’s objectives and the broader aim of the Enterprise. The realization of the portfolio vision is defined and communicated through the current and future state portfolio canvas.

While strategic themes, the portfolio vision, and the current and future state portfolio canvases guide the portfolio, vision, and strategy development is not a once-and-done exercise. As new information is learned about the solution set, including key performance metrics, the LPM function periodically reviews the portfolio canvas (e.g., quarterly) and explores different scenarios in which the portfolio could evolve to a better future state in alignment with the strategic themes.

Enterprise Architecture

The road to a better future state must be developed by following architectural principles and practices that enable the evolution of its solution set. This fact makes enterprise architecture a critical component of strategy and investment funding.

Enterprise architecture is the process of translating the business vision and strategy into effective technology plans. To this end, Enterprise Architects promote adaptive design and engineering practices to drive architectural initiatives (enabler epics) for the portfolio.

Enterprise Architects also facilitate the reuse of hardware and software components and proven patterns across a portfolio. Architects help improve results by fostering Architectural Runway and offering architectural governance. They may include recommendations for technology stacks, value stream level interoperability, APIs, hosting, and methods for designing and testing cyber-physical systems.

Portfolio Roadmap

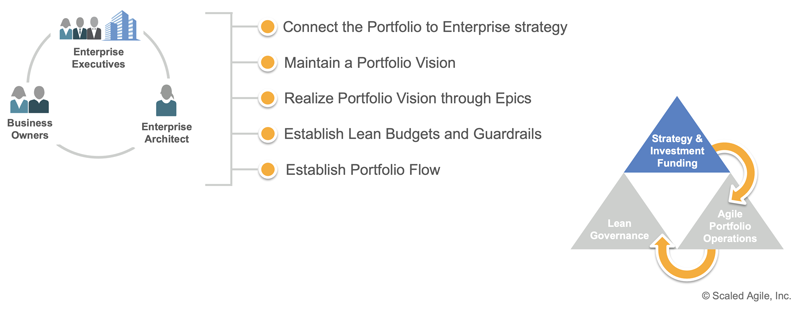

The best way to predict the portfolio’s future state is to create it through a purposeful and flexible roadmap. Because some portfolio initiatives may take years to develop, a planning horizon longer than that captured in the Program Increment (PI) roadmap (two to three PIs) may be required.

A portfolio roadmap integrates aspects of the lower-level roadmaps into a more comprehensive view, communicating the larger picture to enterprise and portfolio stakeholders.

Since the portfolio roadmap may span multiple years, it requires estimating longer-term initiatives using agile methods. However, every enterprise must be cautious about such forecasts. While long-term predictability is indeed a worthy goal, Lean-Agile Leaders know that every long-term commitment decreases the organization’s agility.

Realize Portfolio Vision Through Epics

Some of the changes to achieve the future state will require implementing large initiatives (Epics). Business epics directly deliver business value, while enabler epics are used to advance the Architectural Runway to support upcoming business or technical needs. LPM visualizes and manages the flow of epics through the Portfolio Kanban. Since epics often have lots of uncertainty, the best practice is to use the SAFe Lean Startup Cycle for epic implementation.

LPM needs to understand epics’ costs while maintaining a high-level view of when the potential new value can be delivered (see portfolio roadmap described earlier). The epic’s total cost is the cost of the MVP, which proves or disproves the epic’s hypothesis and the forecasted implementation cost if the epic hypothesis is proven true.

Establish Lean Budgets and Guardrails

Lean Budgets and Guardrails are a set of funding and governance practices that increase development throughput while maintaining financial and fitness-for-use governance. This new funding model allows the enterprise to eliminate or reduce the need for traditional project-based funding and cost accounting, reducing friction, delays, and overhead. Lean budgets provide funding for value streams aligned with the business strategy and current strategic themes. Guardrails support these budgets by providing governance and spending policies and practices.

Establish Portfolio Flow

Portfolio business and enabler epics are used to capture, analyze, and approve new business and technology initiatives. These initiatives typically require the collaboration of multiple value streams or to initiate entirely new value streams and ARTs.

Portfolio flow describes the process of managing portfolio epics through their lifecycle, including limiting the number of significant and typically cross-cutting initiatives in progress to match the portfolio’s capacity. LPM uses the Portfolio Kanban system to visualize and limit work in process (WIP), reduce batch sizes, and control the length of longer-term development queues.

Successfully establishing flow requires knowing the total capacity available for new development work versus ongoing maintenance and support activities. Only when this balance is understood can the enterprise objectively evaluate and originate portfolio-level initiatives.

Agile Portfolio Operations

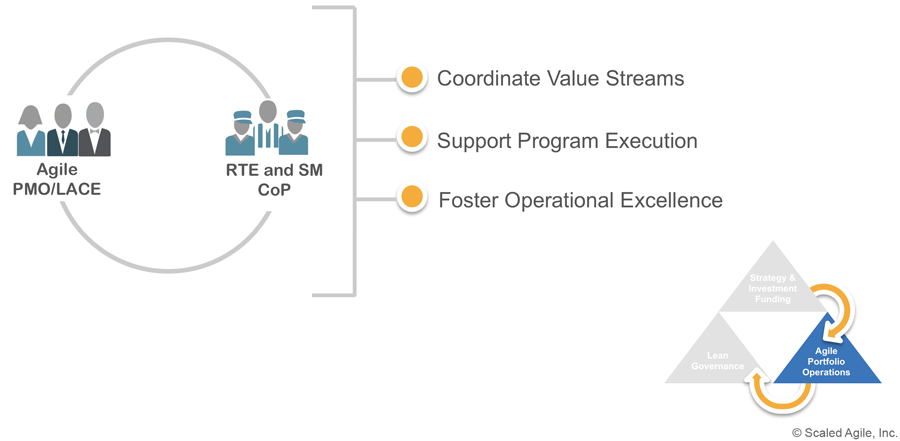

Agile portfolio operations coordinate and support decentralized program execution, enabling operational excellence.

SAFe principles and the Lean-Agile mindset foster the decentralization of strategy execution to empowered Agile Release Trains (ARTs) and Solution Trains. However, systems thinking must be applied to ensure that ARTs and Solution Trains are aligned and operate within the broader enterprise context.

The Agile portfolio operations collaboration and responsibilities (Figure 5) require the active engagement of the Agile Program Management Office/Lean-Agile Center of Excellence (APMO/LACE) and Communities of Practice (CoPs) for Release Train Engineers (RTEs) and Scrum Masters. Each of these responsibilities is described next.

Coordinate Value Streams

Although many value streams operate independently, cooperation among a set of solutions can provide some portfolio level capabilities and benefits that competitors can’t match. Value Stream coordination defines how to manage dependencies to exploit the opportunities that exist only in the interconnections between value streams.

Support Program Execution

Many enterprises have discovered that centralized decision-making and traditional mindsets can undermine the move to Lean-Agile practices. As a result, some enterprises have abandoned the PMO approach, distributing all the responsibilities to ARTs and Solution Trains. Unfortunately, this choice can inhibit the adoption of successful execution patterns, standard program measures, and reporting that can be developed and applied across the portfolio.

An alternative approach is to redesign the traditional PMO to become an Agile Program Management Office (APMO). This leverages the specialized skills, knowledge, and relationships with managers, executives, and other key stakeholders currently possessed by traditional PMO members. They transition themselves and the portfolio to a new way of working.

Operating through the APMO, the LPM function can help cultivate and apply successful program execution patterns across the portfolio. The APMO also establishes objective metrics and reporting toward business agility. It may also sponsor and support CoPs for RTEs (and Solution Train Engineers), as well as Scrum Masters. These role-based CoPs provide a forum for sharing effective Agile program execution practices and other institutional knowledge.

Foster Operational Excellence

Operational excellence is a process that focuses on continually improving efficiency, practices, and results to optimize business performance. The LPM function plays a leadership role in operational excellence, helping the organization achieve its business goals. The Lean-Agile Center of Excellence, or LACE, which may be a standalone group or part of the APMO, is often responsible for leading operational excellence. In either case, the LACE becomes a continuous source of energy to power the enterprise through the necessary organizational changes.

As part of the ‘sufficiently powerful coalition for change,’ the APMO often takes on additional responsibilities. In this expanded role, they usually:

- Lead the move to objective milestones and Lean-Agile budgeting

- Establish and maintain the systems and reporting capabilities

- Foster Agile contracts

- Support leaner and more persistent Supplier and Customer partnerships

- Offer key performance indicators.

- Provide financial governance

- Advise as a communication liaison regarding the strategy to ensure the smooth deployment and operation of the value stream investment

The APMO also supports management and People Operations (Human Resources) in Agile hiring and staff development.

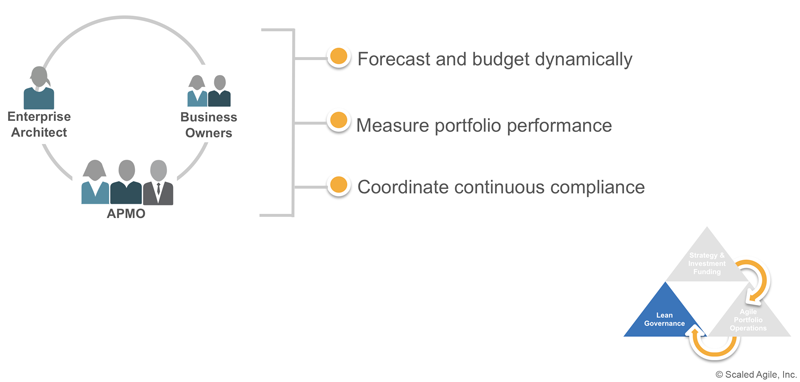

Lean Governance

Lean Governance manages spending, audit and compliance, forecasting expenses, and measurement.

The Lean governance collaboration and responsibilities (Figure 6) require the active engagement of the Agile PMO/LACE, Business Owners, and Enterprise Architects. Their responsibilities are described in the following sections.

Forecast and Budget Dynamically

As described earlier, SAFe provides a Lean approach to budgeting—a lightweight, more fluid, Agile process that replaces the fixed, long-range budget cycles, financial commitments, and fixed-scope expectations of a traditional planning process. This new approach to planning and budgeting includes understanding the historical and forecasted future costs associated with each Solution and forecasted epics costs. Budgets are adjusted on cadence, typically every six months, or when significant events warrant, as part of the Strategic Portfolio Review or Participatory Budgeting Events (see below).

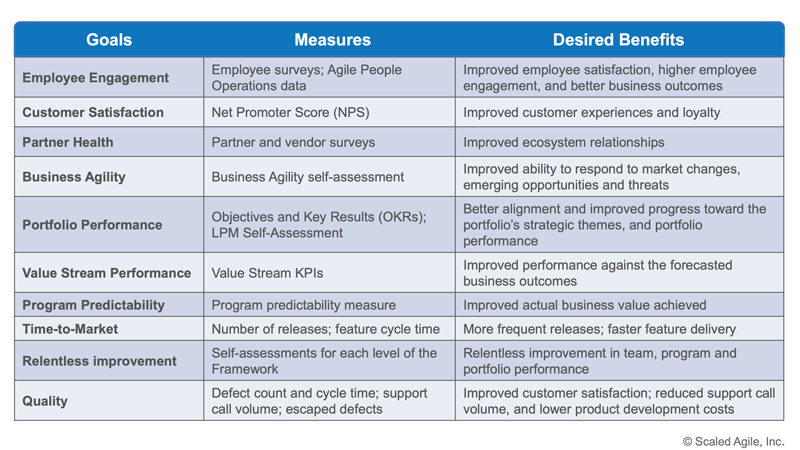

Measure Portfolio Performance

Each portfolio must establish the minimum metrics needed to ensure:

- Strategy implementation

- Spending aligns with the agreed boundaries

- Results are continually improving, without overly detailed oversight of feature implementation by ARTs

The following set of metrics (Figure 7) demonstrates a short, but fairly comprehensive set of Lean measures which can be used to assess progress for an entire portfolio.

Coordinate Continuous Compliance

Lean audit and compliance provide continuous adherence while minimizing overhead and supporting the ongoing flow of value. This may include internal or external financial auditing constraints and industry legal or regulatory guidelines. These obligations impose significant limits on solution development and operations. Traditional compliance procedures tend to defer these activities to the end of the project. That subjects the enterprise to the risk of late discovery and subsequent rework, and even compromising regulatory or legal exposure. Therefore, a more continuous approach is recommended, one that coordinates ongoing compliance with relevant standards.

For more on this topic, see the advanced topic article and whitepaper: Achieving Regulatory and Industry Standards Compliance with SAFe.

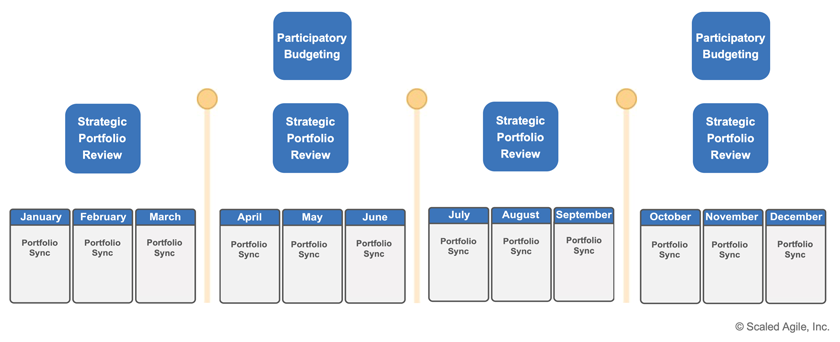

Lean Portfolio Management Events

The effective operation of the LPM function relies on three significant events:

- Strategic Portfolio Review

- Portfolio Sync

- Participatory Budgeting

Typically, these events are held on a cadence, as illustrated in Figure 8.

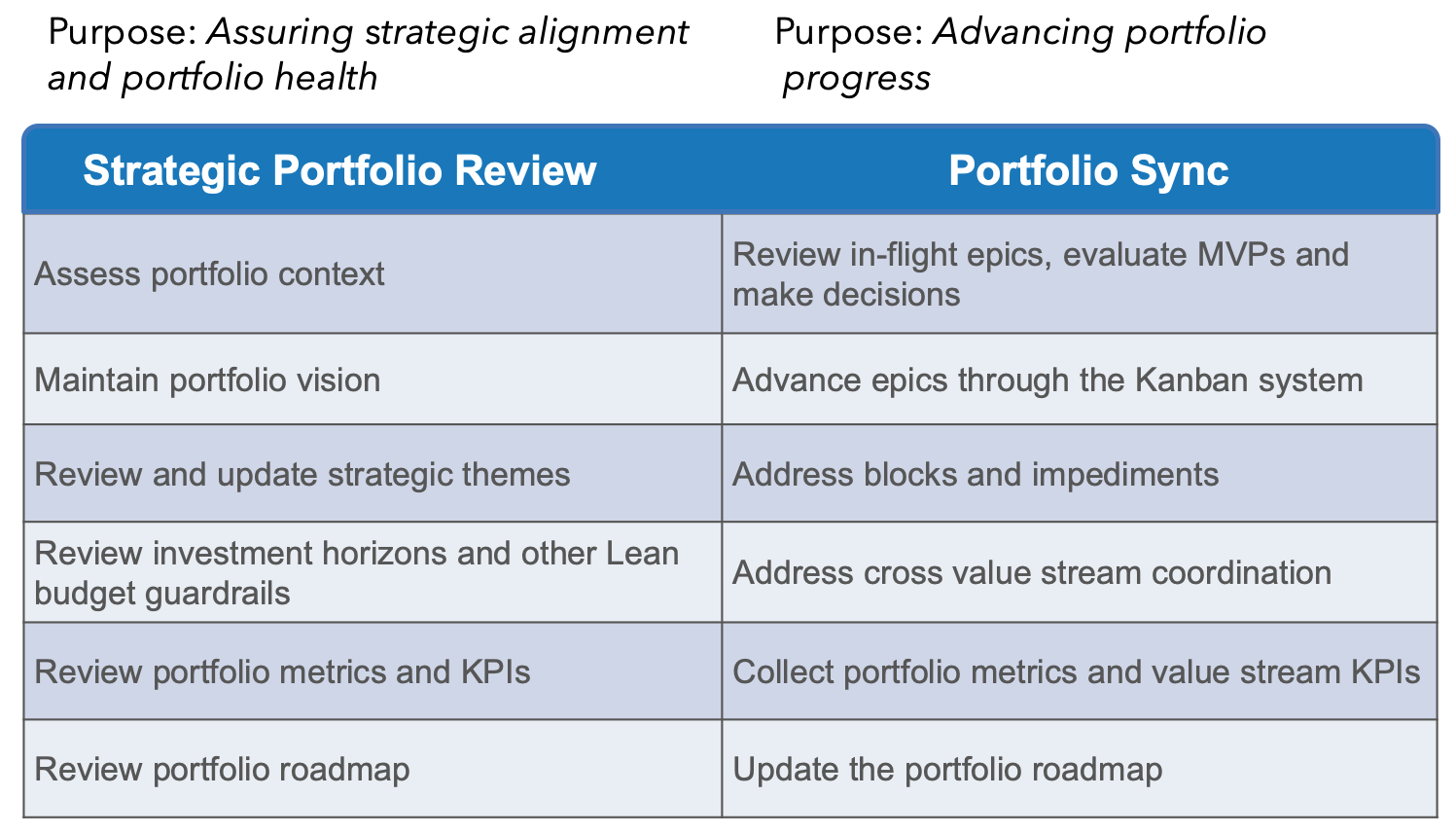

Strategic Portfolio Review

The strategic portfolio review event provides continuous strategy, implementation, and budget alignment. The event is focused on achieving and advancing the portfolio vision. To enable value streams to prepare and respond to any changes, it’s typically held on a quarterly cadence, at least one month before the next PI Planning.

Portfolio Sync

The portfolio sync provides visibility into how well the portfolio is progressing toward meeting its objectives. This event has a more operational focus than the strategic portfolio review. Topics typically include reviewing epic implementation, the status of KPIs, addressing dependencies, and removing impediments. The portfolio sync is typically held monthly and may be replaced on a given month with the strategic portfolio review.

Participatory Budgeting

SAFe Participatory Budgeting (PB) is an LPM event in which a group of stakeholders decides how to invest the portfolio budget across Solutions and Epics. The resulting data is used to finalize any adjustments needed to the value stream budgets. These budgets are typically adjusted twice annually using PB. If adjusted less frequently, spending is fixed for too long, limiting agility. Also, although more frequent budget changes may seem to support increase agility, they may create too much uncertainty and an inability to commit to any near-term course of action. (See Lean Budgets for more information).

Summary

Successfully defining and executing a strategy in a world of increasing uncertainty is challenging. It requires portfolio management practices modernized by applying Lean-Agile thinking and a portfolio organized around value streams that deliver a continuous flow of value to the enterprise’s customers.

Strategy and investment funding ensures the ‘right work’ is happening at the ‘right time.’ Continuous and early feedback on current initiatives, coupled with a Lean approach to funding, allows the portfolio to make the necessary adjustments to meet its business targets. Agile portfolio operations facilitate coordination across the portfolio’s value streams, maintaining alignment between strategy and execution, and fostering continued operational excellence. Lean governance closes the loop by measuring portfolio performance and supporting dynamic adjustments to budgets to maximize value.

Collectively, these competencies work together to create superior economic outcomes.

Learn More

[1] Ries, Eric. The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses. The Crown Publishing Group, 2001. [2] Osterwalder, Alexanderm, and Yves Pigneur. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers. Wiley, 2010.

Last update: 27 September 2021